Bitfinex has restored the ability of customers to make fiat currency deposits. Details of its new deposit system remain shrouded in secrecy, however, with the exchange going to extraordinary lengths to conceal the identity of the bank(s) in question. Its “distributed” system, designed to circumvent censorship, has brought the critics out in full force.

Also read: The Daily: Tether Regains Ground, Coinbase Does Dublin

Convoluted Fiat Deposit Process

After being forced to suspend fiat currency deposits last week, when HSBC terminated its proxy banking relationship, Bitfinex assured customers that an alternative would soon be in place. And the exchange, the world’s second largest by trading volume, has been as good as its word, confirming its new banking relationship earlier today (Oct. 16). However, the opaque nature of the statement, and the odd language it was couched in, have raised more questions than they have answered.

After being forced to suspend fiat currency deposits last week, when HSBC terminated its proxy banking relationship, Bitfinex assured customers that an alternative would soon be in place. And the exchange, the world’s second largest by trading volume, has been as good as its word, confirming its new banking relationship earlier today (Oct. 16). However, the opaque nature of the statement, and the odd language it was couched in, have raised more questions than they have answered.

“Today we are introducing a new, improved and increasingly resilient fiat depositing system for sending fiat currencies to Bitfinex,” began the blog post. “This new process will once again allow KYC-verified users from around the world to initiate deposits across USD, GBP, JPY and EUR.”

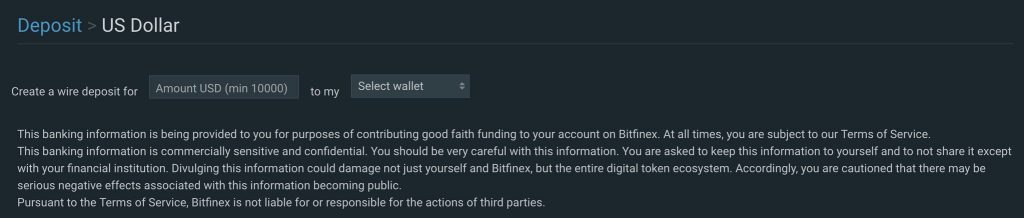

The exchange then proceeded to describe a complex process by which customers must deposit a minimum of $10,000 of fiat currency from now on. This involves creating a deposit request to signal interest, waiting up to 48 hours for Bitfinex to approve it, sending money to the bank account, and then waiting six to 10 days for the funds to clear. Coinbase, by way of comparison, takes an average of three to five days to clear bank transfers.

Customers Sworn to Secrecy

Bitfinex’s statement ends on a defiant note, with the exchange asserting: “We believe this system to be significantly more durable in the face of sustained attacks by our competition and their supporters. Ongoing campaigns against us will only result in our company becoming stronger and better.”

Bitfinex’s statement ends on a defiant note, with the exchange asserting: “We believe this system to be significantly more durable in the face of sustained attacks by our competition and their supporters. Ongoing campaigns against us will only result in our company becoming stronger and better.”

While Bitfinex undoubtedly has its share of haters who would like to see the platform toppled, most traders simply seek clarity. The inability of the exchange’s operators to publish a full audit of Tether, exacerbated by its own nebulous banking arrangements, has not helped matters. Still mindful of what happened to Mt. Gox, the crypto community would like reassurance that funds are safe.

There may be serious negative effects with this information becoming public.

The Block has revealed that Tether has obtained a new Caribbean bank, after recently severing ties with Nobles. It’s now believed to have shacked up with the Bahamas-based Deltec Bank. However, it is unclear whether the same bank will also handle Bitfinex’s customer deposits.

Anyone attempting to initiate the new fiat deposit process on the exchange is greeted by a disclaimer that warns in almost apocalyptic terms: “Divulging this info could damage not just yourself and Bitfinex but the entire digital token ecosystem … you are cautioned that there may be serious negative effects with this information becoming public.”

The status of Bitfinex/Tether is becoming a new battleground in the cryptocurrency community, with lines drawn and both tribes seemingly incapable of backing down. On the one hand, there are those who are certain of impropriety of some kind and are waiting to be vindicated when the house of cards topples. On the other hand, there are the defenders of Bitfinex, who are weary of fighting what they deem to be endless FUD. Today’s statement has done nothing to resolve the impasse.

What are your thoughts on Bitfinex’s latest banking arrangements? Let us know in the comments section below.

Images courtesy of Shutterstock.

Need to calculate your bitcoin holdings? Check our tools section.

The post Bitfinex Introduces Top Secret Banking System appeared first on Bitcoin News.

from Bitcoin News https://ift.tt/2EqKHxS

via BITCOIN NEWS

from BITCOIN NEWS https://ift.tt/2ymrWGd

via Bitcoin News Update

from Bitcoin News Update https://ift.tt/2AdKCtm

via IFTTT